If you are running an ecommerce site then it's highly likely that you are also shipping items to fulfil your customer orders.

In the majority of cases, VAT should be charged on shipping at the standard rate (currently 20% in the UK and 23% in the Republic of Ireland). Within Cloud POS, we have created an item with the lookup code 'Ship' and this will be automatically applied to any web order which is due to be shipped.

You should check that you have the correct Tax rate set on this item:

However, there may be occasions when you need to ship an order and substitute the VATable item for a Tax-Exempt shipping item.

To do this, firstly you will need to create the item. A simple way to do this is to copy the existing Ship item using the Copy Item button:

Give the item a unique Item Lookup Code and Description, such as in the example below, set the Item Tax to be Zero-rated, then click Save:

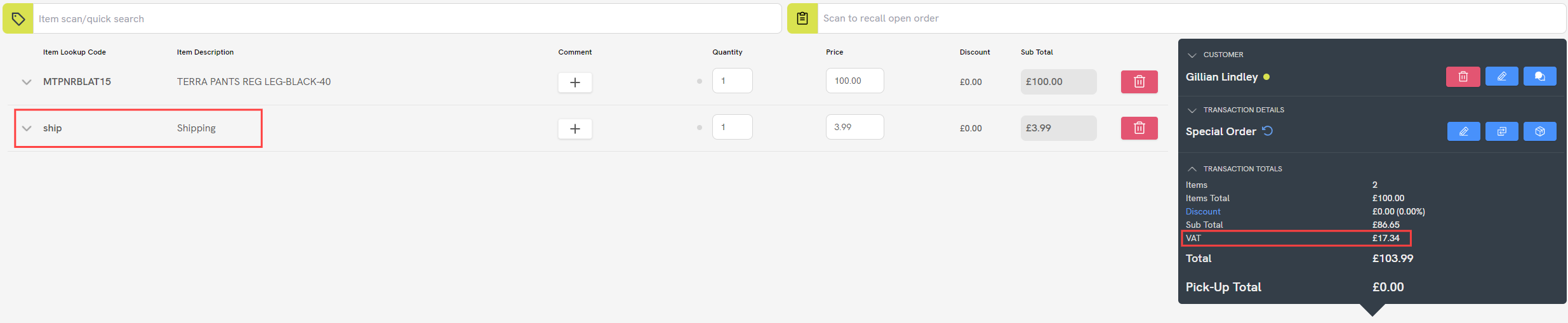

When processing an e-commerce order in Point of Sale, the order will download with the standard, VATable shipping item applied:

When processing an e-commerce order in Point of Sale, the order will download with the standard, VATable shipping item applied:

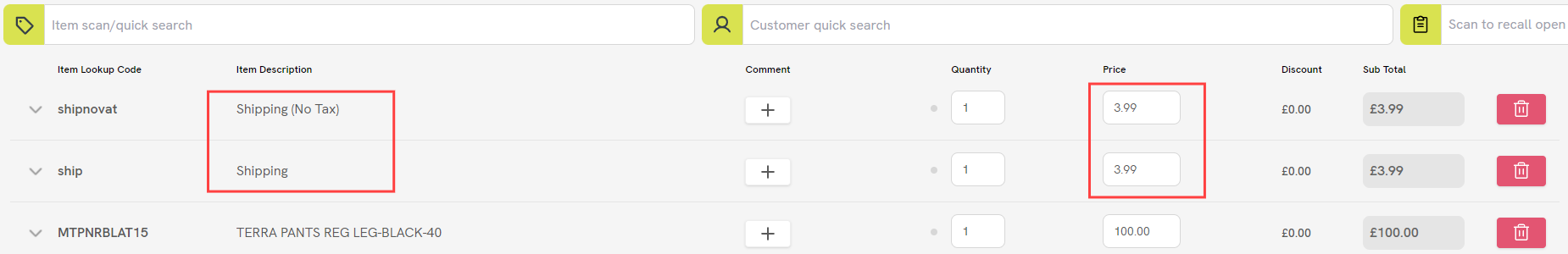

You now need to add your Zero-rated shipping item. As you do this, you'll see a warning stating that you are adding an item to an e-commerce order. Click OK to move past this. Set the price of the Zero-rated shipping item to match that of the current Ship item:

Next, click on the 'bin' icon to the right-hand side of the VATable shipping item, and this will remove the line.

If the web order was paid for using a tender type that is supported with integrated e-commerce refunds, you'll see a prompt asking if you would like to process a refund for the value of the item you are removing. Click No here, as you do not want to refund the shipping charge the customer has paid; you are simply substituting one shipping item for another.

If you are ready to tender the transaction, you can now tick the Select All For Pick-Up? checkbox, click the Tender button, and proceed to complete the transaction as normal.