BEFORE PROCEEDING….

It is the responsibility of the retailer to input any missing data into Xero, however the Support Team are on hand to guide you. We are not Accountants and are not trained to provide detailed accounting assistance.

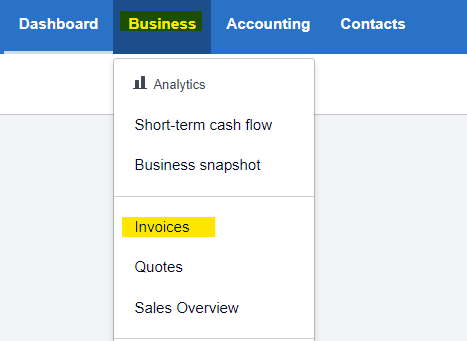

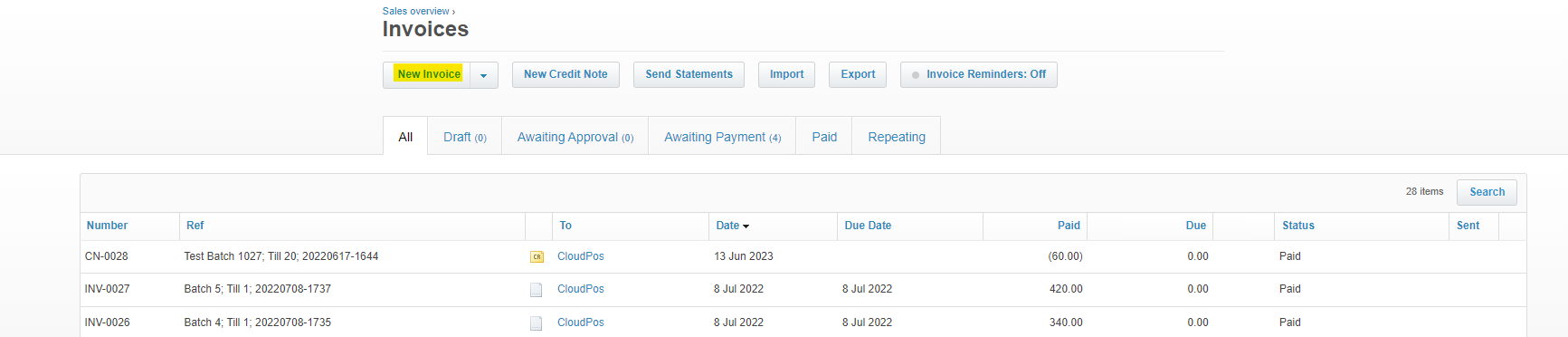

Within your Xero, you'll want to navigate to Business > Invoices.

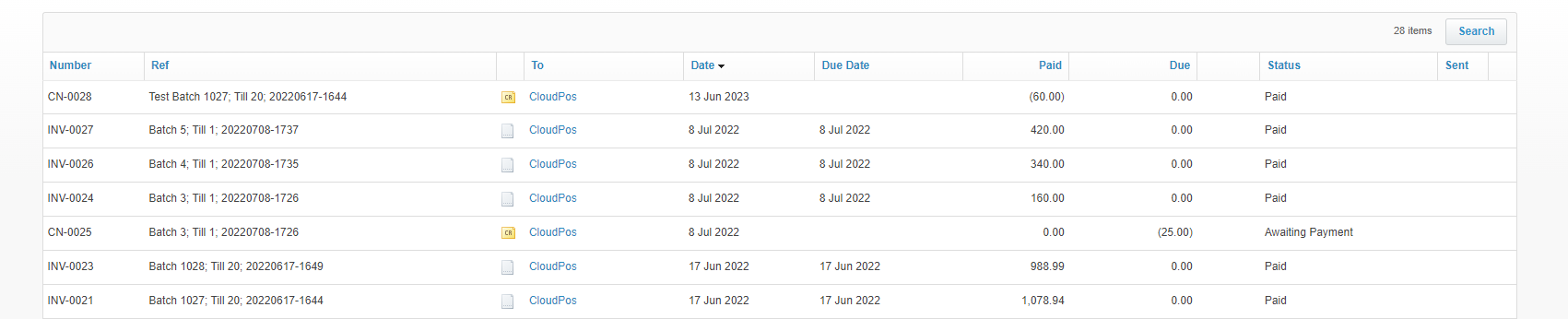

From here, you can see all your batches. I would recommend opening one as a reference in a new tab.

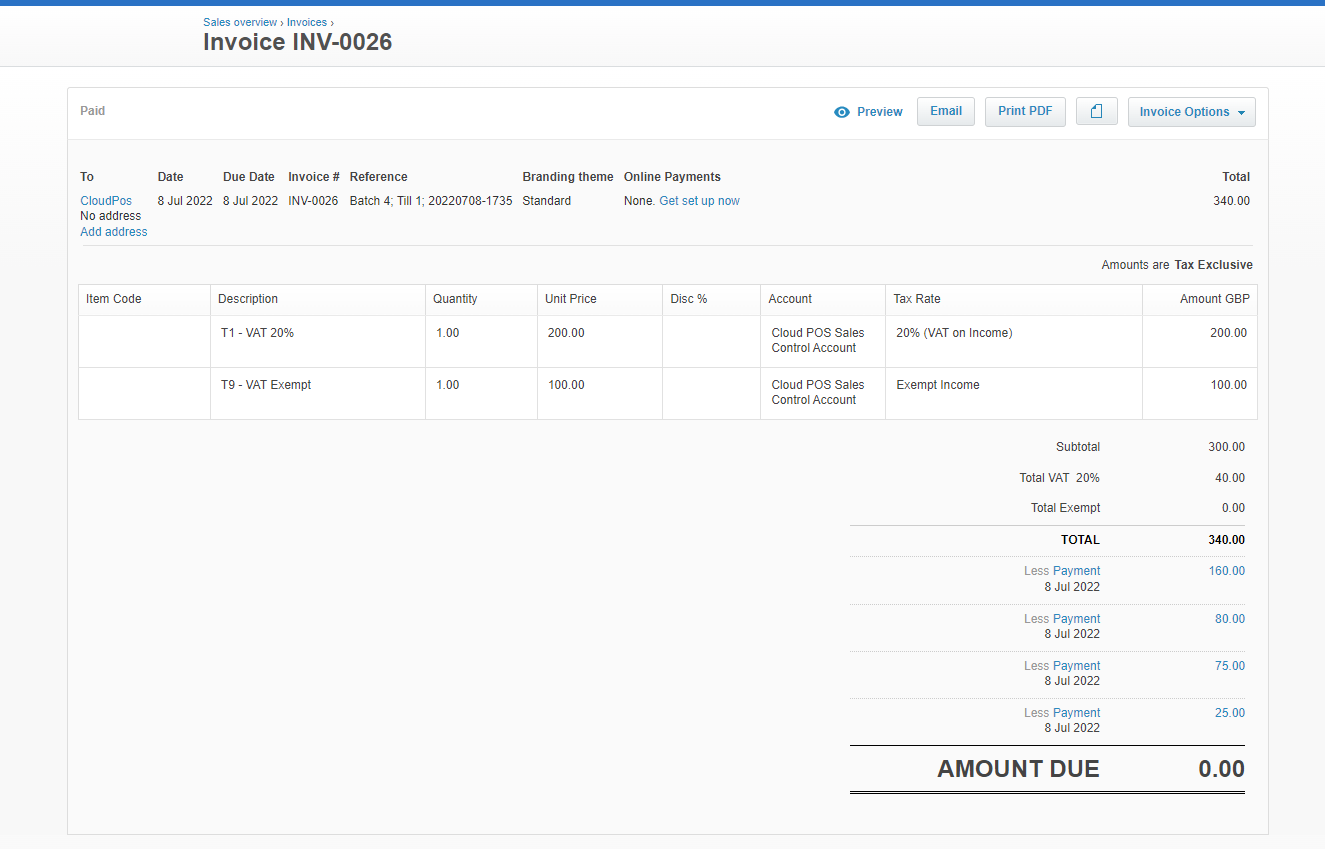

Example Invoice for reference:

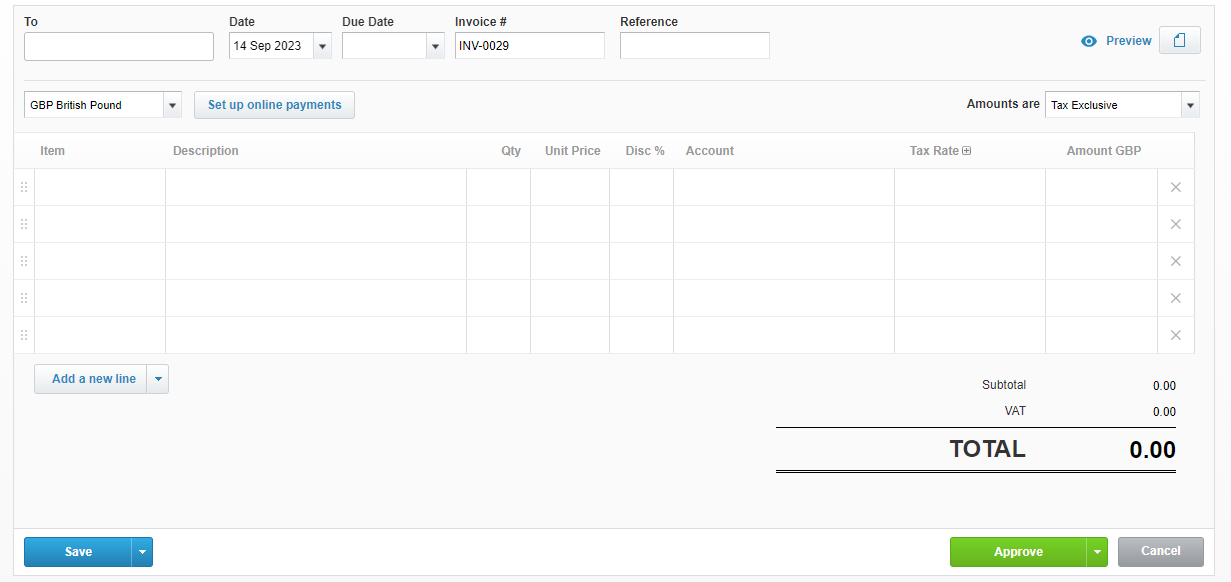

You can then select 'New Invoice' from the main Invoices page;

I would advise using your reference invoice to fill in the details at the top and mention in the reference field that this has been manually created.

Your blank invoice should look like this;

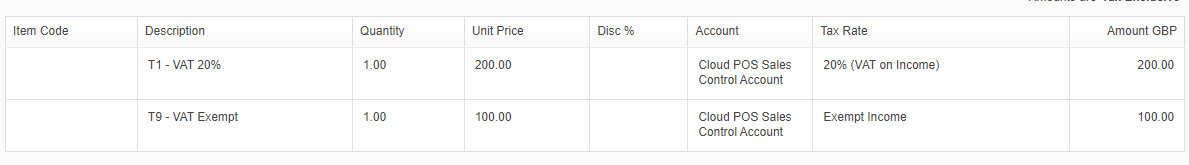

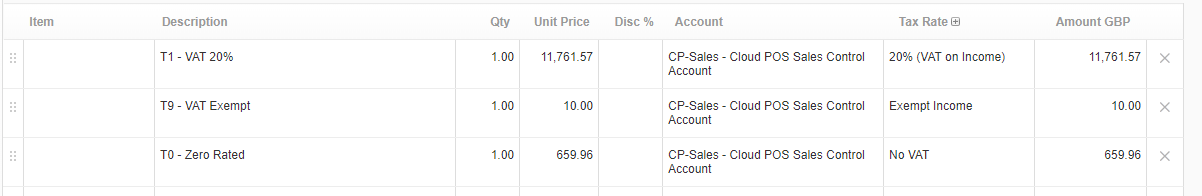

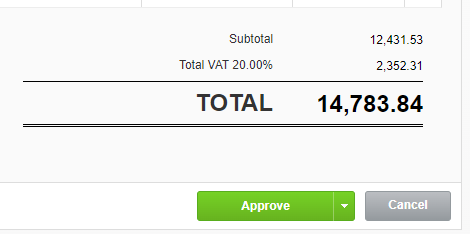

From the reference invoice you can see that the invoice is split by Tax Rate;

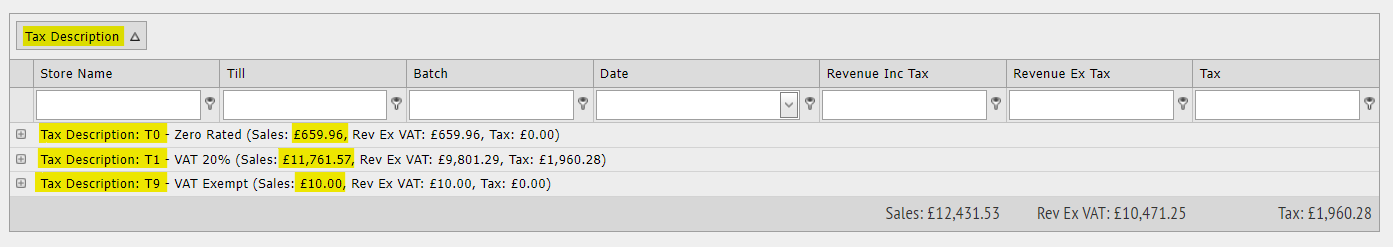

You can use the Tax Breakdown Report grouped by Tax Description for these totals and add them in;

At this point you can select ‘Approve’

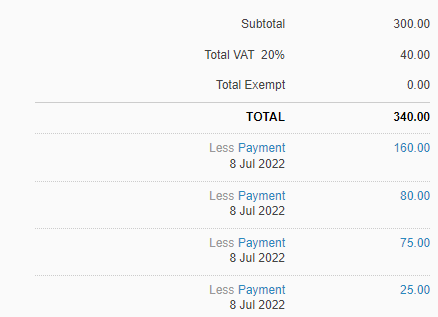

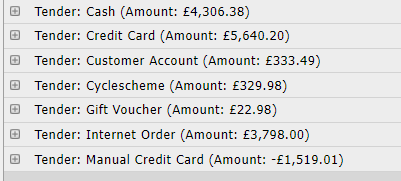

If we take a look at our reference invoice, underneath the Total column, we can see the payments split by Tender Type;

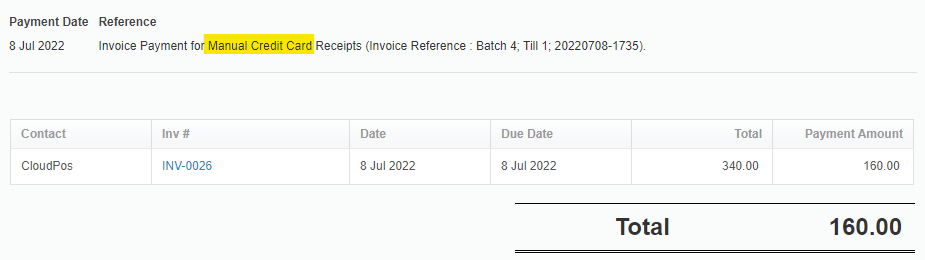

If you click into each Payment, you can see the corresponding Tender Type;

We can now add these details in to our new invoice as payments using the Tender Detail Report grouped by ‘Tender’ as a reference;

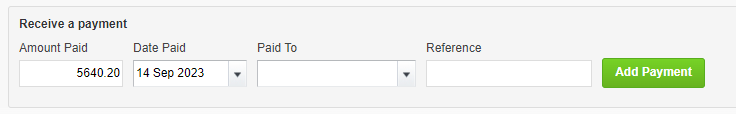

You can add these payments below the Approved Invoice;