The Average Weighted Cost of an item is calculated by dividing the total cost of an item by the quantity you hold in stock within the business.

This is an important calculation, as it allows your inventory valuation to be as accurate as possible.

This article will give some examples to help explain how this works in different situations.

NOTE: This functionality will only be accurate if you are disciplined about updating your cost prices as you receive goods into the business. Please see the related articles section for guidance on this.

Average Weighted Cost within a single store environment

Let's say you receive into stock 2 of item XYZ via a purchase order, at a cost price of £10.00.

Your average weighted cost will be £10.00.

20 (total cost of items) divided by 2 (quantity in stock) = 10

You then receive another 2 into stock via a purchase order, but your cost price has now risen to £12.00.

You now have 4 in stock, and have paid your supplier a total of £44.00 for those items.

The average weighted cost is therefore £11.00. This is calculated this way:

44 (total cost of items) divided by 4 (quantity in stock) = 11

You sell one of item XYZ, but your average weighted cost remains at £11 because you have paid your supplier, on average, £11 for each of the 3 items you have remaining in stock.

Now let's say you receive a further 1 of XYZ into stock via a purchase order, but this time your supplier has increased your cost to £15.00.

You have 4 in stock and your average weighted cost increases to £12.00. How is this worked out?

33 (total cost of the items you already had in stock) + 15 (last cost you paid the supplier) = 48

48 divided by 4 (quantity in stock) = 12

A customer enters your store and purchases all your stock of item XYZ, so you need to order more from your supplier.

This time, you find your cost price has reduced to £8.00, and you receive 2 into stock via a purchase order.

The average weighted cost of the item is now £8.00.

This is because you have paid a total of £16.00 for the two items you have in stock:

16 (total cost of items) divided by 2 (quantity in stock) = 8

So, the examples above illustrate how the average weighted cost accurately tracks the value of the stock you hold of a particular item.

Average Weighted Cost within a multi-store environment

This becomes more complicated due to the fact that different stores may have different cost prices for the same item, and because stock may be transferred between stores. However, the principle remains the same.

A key thing to note is that in a multi-store environment, the weighted average cost is calculated and displayed at store level. This is important as reporting is focused on the stock value held at store level. So, whilst you will still see a weighted average cost figure towards the top of an item record, this is a global figure and is less relevant than the store level costs.

Also notable is that when stock is transferred from store to store, the cost price of the item on the transfer is taken from the store sending the stock.

Let's take a look at a few example situations in an environment with two stores, see how the average weighted cost is calculated in these circumstances, and how each store's cost price is affected on the Inventory section of a product record.

1) Stock available in Store One but out of stock in Store Two

When you first create the item in Cloud POS, you will enter your initial cost into the weighted average cost field. That will populate the cost field for both stores in your Cloud POS group.

If you only ever receive stock of that item into Store One, then the cost field of that item will update for Store One accordingly as you receive stock but for Store Two, it will remain at the original cost price you entered when the item was created.

The weighted average cost will only be calculated from Store One, as that is the location holding the stock.

2) Stock available in Store One and Store Two

In this example, Store One and Store Two both have a cost price of £10.00 for item XYZ.

Store One holds 3 in stock of the item, and Store Two holds 1 in stock, making a total of 4 in stock within the business.

The weighted average cost of the item is £10.00. How is this calculated?

30 (total cost of stock at Store One) plus 10 (total cost of stock at Store Two) = 40

40 (total cost of stock at both stores) divided by 4 (total quantity of stock within the business) = 10

3) Store One pays a different cost price to Store Two

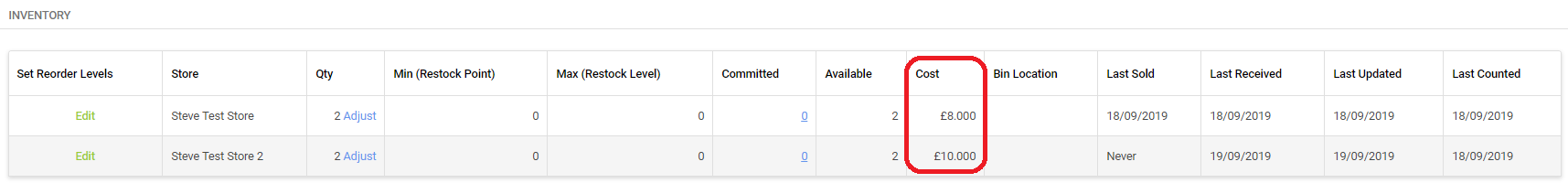

In this example, Store One pays £8.00 for item XYZ but Store Two pays £10.00.

Store One has 2 in stock and Store Two has 2 in stock, giving a total of 4 in stock within the business.

The weighted average cost of the item is £9.00. How is this calculated?

16 (total cost of stock at Store One) plus 20 (total cost of stock at Store Two) = 36

36 (total cost of stock at both stores) divided by 4 (total quantity of stock within the business) = 9

You would see each store's cost price represented on the Inventory section of the item record in Cloud POS backoffice as below:

4) Store One pays a different cost price to Store Two - Store One transfers stock to Store Two

Here we look at what happens when the two stores have different cost prices for the same item, and transfer stock from one store to another.

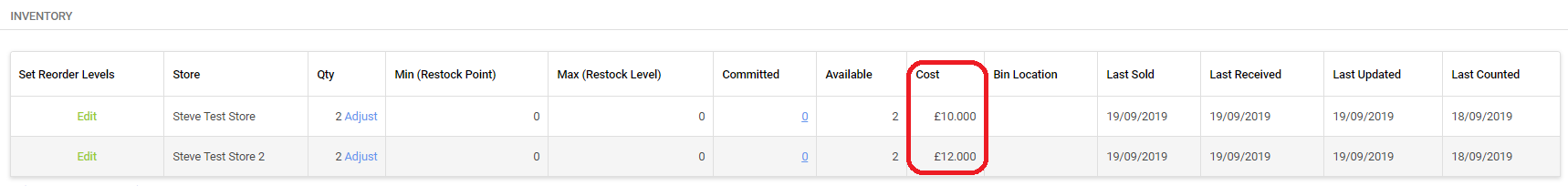

Store One pays £10.00 for item XYZ and has 2 in stock. Store Two pays £12.00 for the same item, and has 2 in stock.

In the Inventory section of the item record in Cloud POS backoffice, we can see each store's cost price represented as below:

The average weighted cost for the item is £11.00. How is this calculated?

10 (total cost of stock at Store One) plus 24 (total cost of stock at Store Two) = 44

44 (total cost of stock at both stores) divided by 4 (total quantity of stock within the business) = 11

So what happens to the cost field for each store when stock is transferred from Store One to Store Two?

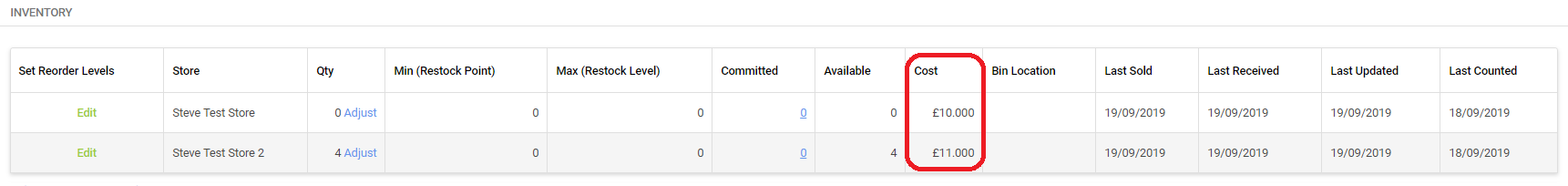

Here Store One has used a Store to Store Transfer to transfer 2 of item XYZ to Store Two. Store Two now has 4 in stock in total:

We can see that the Cost field for Store Two has now updated to £11.00. Why? This is because, within the business as a whole, an average of £11.00 has been paid for those items, and Store Two now holds all the stock within the business.

This is an example of the weighted average cost being calculated at store level. We can track the cost to the business of the goods at a specific location.

5) Store One receives more stock

In this example, we'll continue from the scenario in example 4 above, and show what happens when Store One then receives further stock of item XYZ on a purchase order. To help make this more realistic, we'll also change the cost price paid by Store One.

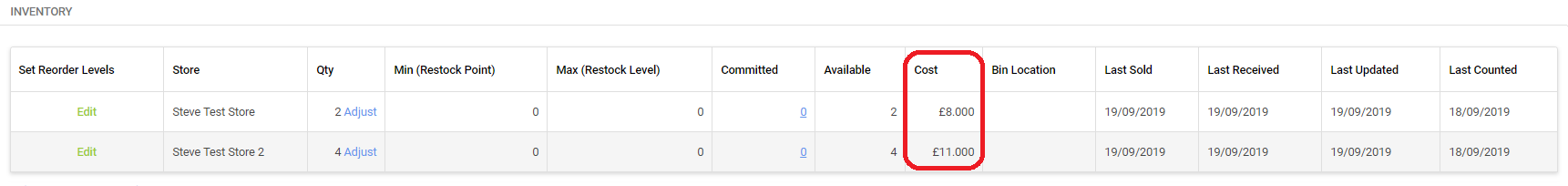

Here, Store One has received 2 of item XYZ into stock on purchase order, and have paid a cost price of £8.00 per item.

This now gives a total of 6 in stock within the business, with 2 in stock at Store One and 4 in stock at Store Two.

The average weighted cost is £10.00. How is this calculated?

16 (total cost of stock held by Store One) plus 44 (total cost of stock held by Store Two) = 60

60 (total cost of stock holding within the business) divided by 6 (total stock within the business) = 10

In the Inventory section of the item record in Cloud POS backoffice, we can see each store's cost price represented as below:

6) In the final example, we'll continue with scenario in example 4 above, to illustrate how the cost price at the stores is affected when Store One uses a Store to Store transfer to move 1 of item XYZ to Store Two, when Store One now pays a different cost price.

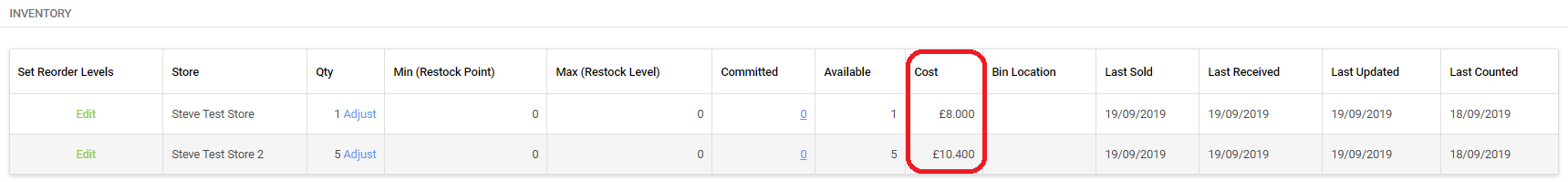

When the item is received on the transfer at Store Two, we now see the cost price for this store has increased to £10.40.

Why is this? This is the calculation:

44 (total cost of stock held at Store Two) plus 8 (cost paid by Store One for the item) = 52

52 (total cost of stock now held at Store Two) divided by 5 (quantity in stock at Store Two) = 10.4

So, as illustrated in the examples above, the average weighted cost allows accurate reporting of the actual cost that the business has paid for the stock, as it moves around within the business.

NOTE: Although the examples above only show two stores, the same principles apply to an environment with multiple stores.