This article explains how to process cycle scheme vouchers for customers in-store. For guidance on processing Cyclescheme orders from your Ecommerce site, please see the related article.

When making a sale using a cycle scheme voucher in-store, the process is the same as using any other tender type.

The cycle scheme voucher should be processed at face value, eg a £1000 transaction should be paid in full with a £1000 voucher.

Different tender types can easily be set up, for different schemes, if preferred (e.g. Halfords Voucher, GCI Voucher). See the article on creating Tender Types.

The difference between this and the final paid amount, due to the scheme commission, can be viewed as the service charge, in the same way you pay for card payment processing.

Some Cloud POS users leave these adjustments to their bookkeeper/accountant. As long as these sales are run through under a cycle scheme tender type, your bookkeeper/accountant can verify each voucher payment received from the scheme provider.

Alternatively, some Cloud POS users choose to account for the scheme commission deductions within Cloud POS. This is most commonly achieved using non-inventory items, for example by creating an item with the Item Lookup Code 'COMMISSION' and the description 'Scheme Commission'.

Separate non-inventory items could also be created for different scheme providers, if desired, for example, 'GCICOMMISSION' vs. 'HALFORDSCOMMISSION'.

These non-inventory items can then be added to a transaction and set to 'Refund Item', to create a negative value. There are two broad methods for doing this.

Method 1: Add the non-inventory item to the original transaction

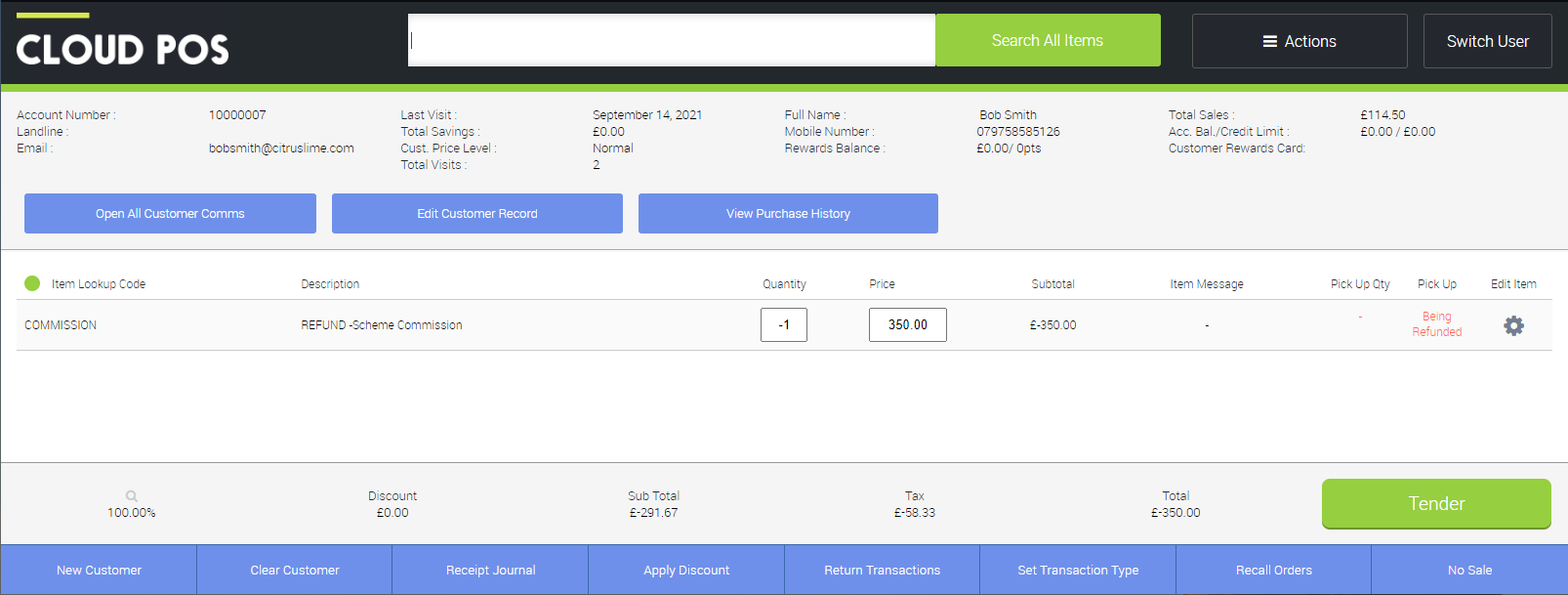

When tendering the sale through, add the non-inventory item into the transaction and set its price to the value of the commission on that sale. Click the 'Edit Item' cog and choose 'Refund Item'. This will reduce the overall total by the value of the commission. Tender the sale through to a cycle scheme tender type.

For example:

Method 2: Add the non-inventory item to a new transaction

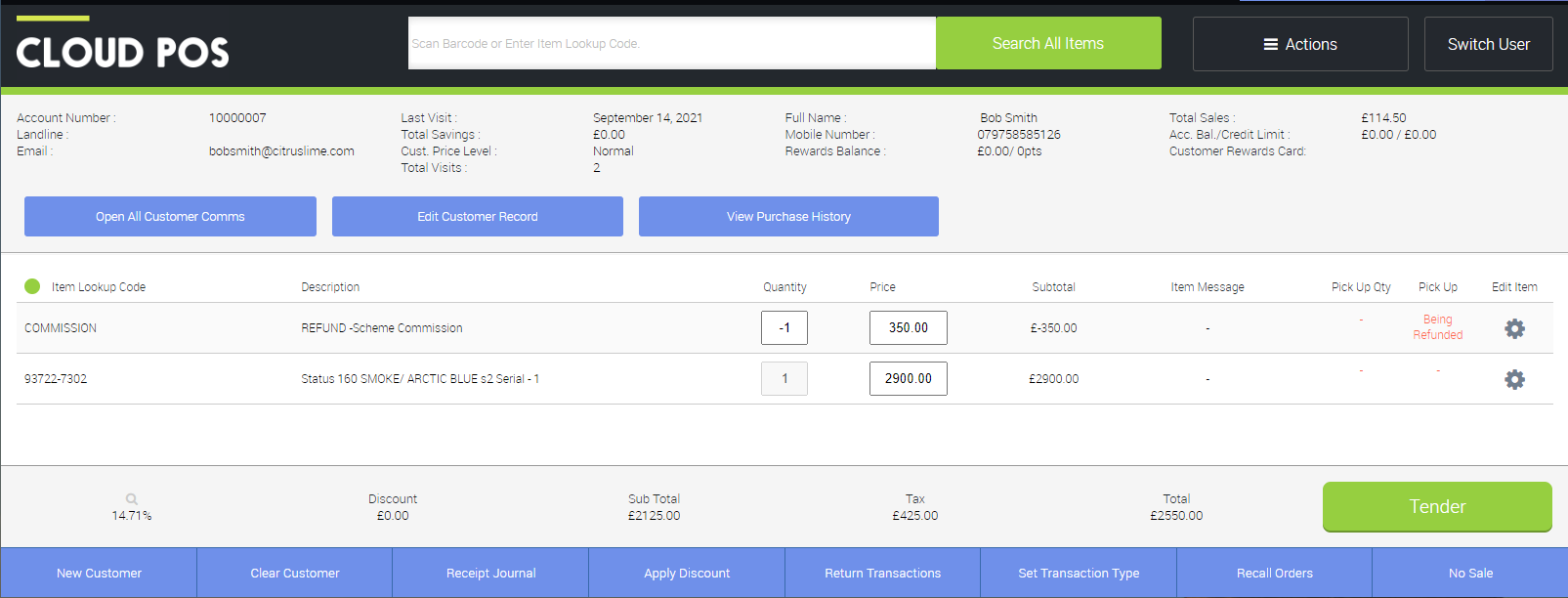

Following this method, the sale would be tendered through without the non-inventory item. Then, at a later date, a new transaction would be created (for the same customer), containing only the non-inventory item for the commission deduction. Again, this would be set to 'Refund Item', and would be tendered to the same Tender Type as the original transaction. This will result in an overall tendered total of the original sale less the commission when reviewing sales across the period.

This method is useful if there is a delay between tendering the sale of the transaction for the customer and confirmation of the commission/fees from the scheme provider.

For example: